- The Luxury Playbook Weekly Round-up

- Posts

- Weekly Round-up

Weekly Round-up

Actionable intelligence, not noise.

Agenda

Spotlight

Fine Assets

Real Estate

Equities

The Death Of Easy House Flipping Profits In America

House flipping once promised accessible wealth creation for investors willing to hustle. The formula seemed straightforward: buy distressed property below market value, renovate efficiently with contracted labor or sweat equity, then sell quickly for substantial profit requiring minimal long-term capital commitment or landlord responsibilities.

Between 2012 and 2021, this strategy delivered consistently, with flippers routinely achieving 50% to 63% gross returns on investment according to ATTOM data reported by Brazil, enabled by sub-3% mortgage rates that allowed buyers to afford renovated homes at premium prices over comparable older properties.

What changed fundamentally wasn’t a single shock but rather the convergence of multiple adverse factors compressing margins from both acquisition and exit sides simultaneously.

Surging property acquisition costs as investors competed with first-time buyers priced out of new construction, rising renovation expenses driven by labor shortages and material inflation, mortgage rates elevated to 6% to 7% levels doubling buyer monthly payments, and a broader affordability crisis limiting the pool of qualified buyers willing to pay flipper premiums all combined to destroy the business model that generated wealth for thousands of small investors during the previous decade.

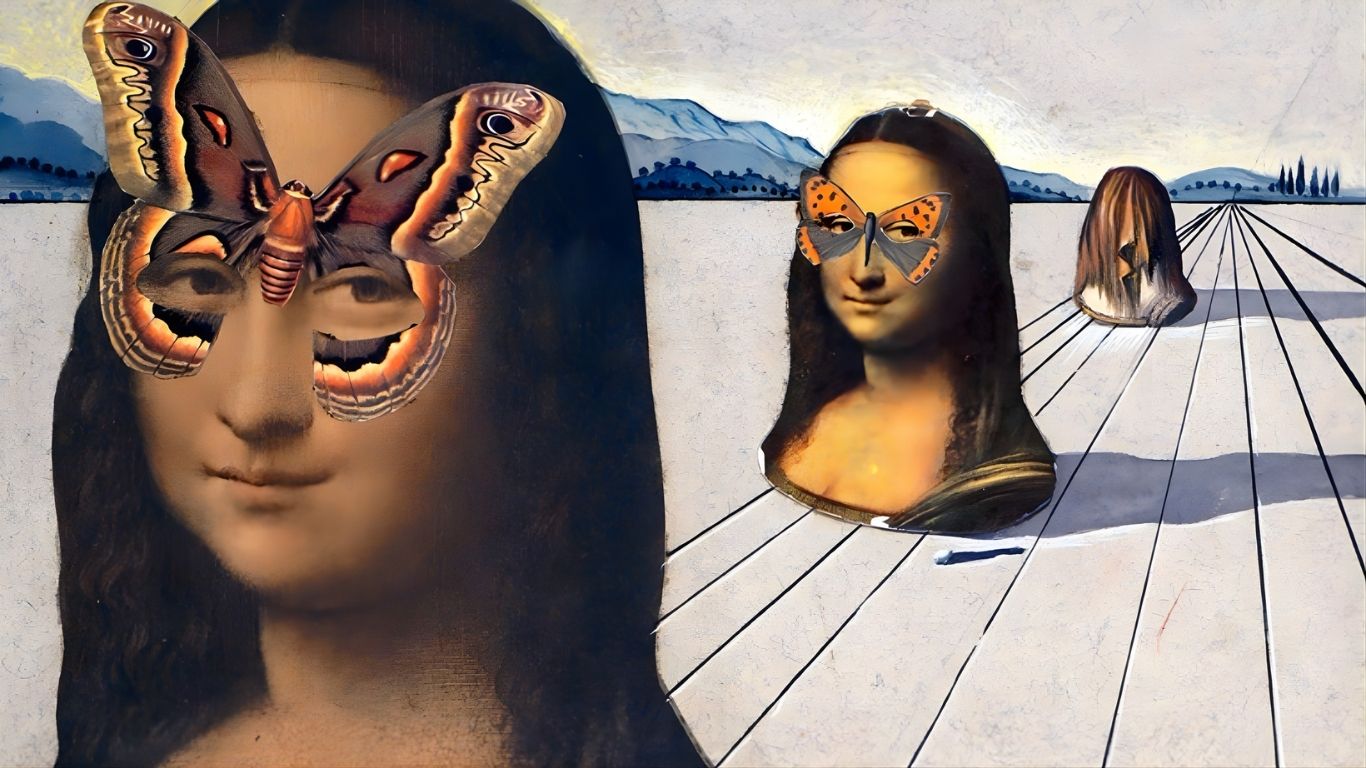

The Art World’s Obsession With Safety Is Killing What Makes Art Matter

The contemporary art world presents a curious contradiction. Every gallery opening, every art fair, every biennial declares itself a celebration of boundary-breaking creativity and fearless innovation.

Yet beneath this rhetoric lies a market that increasingly rewards the familiar, the established, and the financially predictable. The artists who genuinely challenge conventions often find themselves outside the golden circle of commercial success, while collectors pay premium prices for names they already know.

This isn’t a failure of artistic vision. It’s the inevitable result of how the art market has evolved into a high-stakes financial ecosystem where risk has become a luxury few can afford.

The disconnect between artistic innovation and market reward has never been more pronounced. While museums celebrate experimental practices and critics champion emerging voices, the auction houses and blue-chip galleries that drive the market’s financial engine operate with increasingly conservative logic.

The Best Prosecco Brands That Actually Attract Collectors

Prosecco Brands have long suffered from an image problem that no amount of sales volume could solve. In the popular imagination, it remains the cheap celebration bottle, the casual aperitivo sparkler, the fizzy alternative you order when Champagne feels too serious or too expensive.

This perception persists even as the category has undergone a quiet transformation over the past five years, one that has escaped the notice of most collectors still fixated on Burgundy allocations and Bordeaux futures.

While the wine world’s attention focused elsewhere, a small tier of premium Prosecco producers began doing something remarkable: they started making wines that could age, appreciate, and command serious prices in secondary markets.

The evolution accelerated dramatically between 2020 and 2025, driven by stricter DOCG classifications, the emergence of documented single-vineyard bottlings, and a new generation of producers treating Prosecco with the same terroir-obsessed rigor that Champagne houses brought to their grand crus.

According to Wine Spectator and Liv-ex data, premium Prosecco as a category has shown growth rates that outpace comparable Champagne segments in certain price bands, particularly in the $25 to $50 retail range where quality improvements have been most dramatic.

Audemars Piguet Royal Oak Is Officially One Of The Best Investment Grade Watches

The luxury watch secondary market is experiencing a significant correction throughout 2025, with many models that soared during the 2021 and 2022 speculative frenzy now depreciating 20% to 40% from peak values. This downturn is separating genuine investment-grade timepieces from speculative bubble casualties that rode hype cycles driven by social media rather than fundamental collector demand or horological merit.

Current market data suggest the Audemars Piguet Royal Oak is delivering consistent profits through exceptional value retention on standard steel models, genuine appreciation on discontinued references and complications, plus stable liquidity across global secondary markets.

Many Royal Oak references are outperforming comparable Rolex sport models on a risk-adjusted basis while remaining accessible without multi-year waitlists or dealer allocation games, making the collection a legitimate investment-grade timepiece for collectors seeking financial returns rather than Instagram validation or status signaling.

London’s Wealthiest Investors Are Betting On Multi-Occupancy Real Estate

London’s luxury property market is undergoing a fundamental transformation as investors shift their money away from single-family prime assets toward high-end multi-occupancy developments including co-living spaces, serviced apartments, and boutique rental residences.

This isn’t a small change at the edges but a major shift reflecting stronger rental returns, diversified income streams, and tenant lifestyle changes favoring flexibility and premium service over traditional ownership models.

Knight Frank’s 2024 data combined with Savills research shows that institutional and private investors have poured over £1.1 billion into London’s co-living sector over the past five years, including £250 million in 2024 alone.

These aren’t speculative bets but calculated moves by smart money managers who’ve identified multi-occupancy as offering better risk-adjusted returns compared to traditional prime residential assets that have dominated London luxury investment for generations.

How To Build A US And Europe Stock Portfolio With Clean Sector Roles

Most investors face a problem they don’t recognize until market conditions shift violently against them. Their portfolio, despite appearing diversified across dozens or hundreds of holdings, is actually overexposed to a single market narrative (either US Stocks or Europe Stocks) and one dominant sector theme.

This happens because adding more US stocks to existing US stocks doesn’t create meaningful diversification when both allocations rise and fall on the same drivers. Technology dominates American indices so completely that buying a broad US equity fund and then adding a growth-focused US fund results in double exposure to the same handful of mega-cap names and the same interest rate sensitivity.

When that theme works, the redundancy feels clever. When it reverses, the concentrated losses feel brutal.

The solution requires thinking about geographic allocation differently, not as a way to own more stocks but as a method to assign each region a distinct job within the portfolio structure.

This approach treats the US sleeve as the growth engine, the part of the portfolio carrying duration-sensitive innovation and earnings expansion stories. The European sleeve functions as cash flow ballast, weighted toward financials, industrials, and dividend-generating businesses that behave differently across market cycles

When implemented properly, this clean division of labor creates smoother portfolio outcomes across cycles without requiring perfect timing or guaranteed outperformance in any single quarter.

At The Luxury Playbook, we don’t follow the market—we analyze it, decode it, and stay ahead of it.”