- The Luxury Playbook Weekly Round-up

- Posts

- Weekly Round-up

Weekly Round-up

Actionable intelligence, not noise.

Agenda

Spotlight

Fine Assets

Real Estate

Equities

Why HNWIs Are Abandoning Public Markets For Private Equity In 2025

Private equity is becoming a top choice for high-net-worth investors in 2025, and the reasons are clear. With stock markets facing frequent ups and downs, inflation staying stubbornly high, and bonds offering only modest returns, wealthy investors are looking for better places to put their money.

More and more, they’re finding that in private equity.

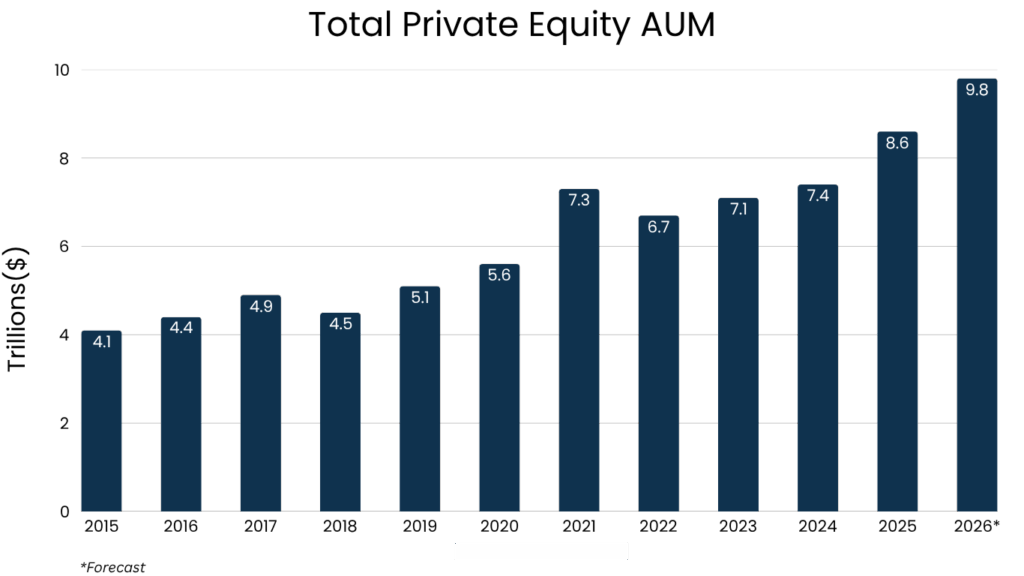

The numbers show just how big this shift is. As of early 2025, private equity assets under management (AUM) have climbed to around $8.6 trillion, almost double what they were six years ago. Industry forecasts expect that figure could cross $10 trillion by the end of 2026.

A lot of this growth is coming straight from individual wealthy investors who want more control over their portfolios and stronger returns.

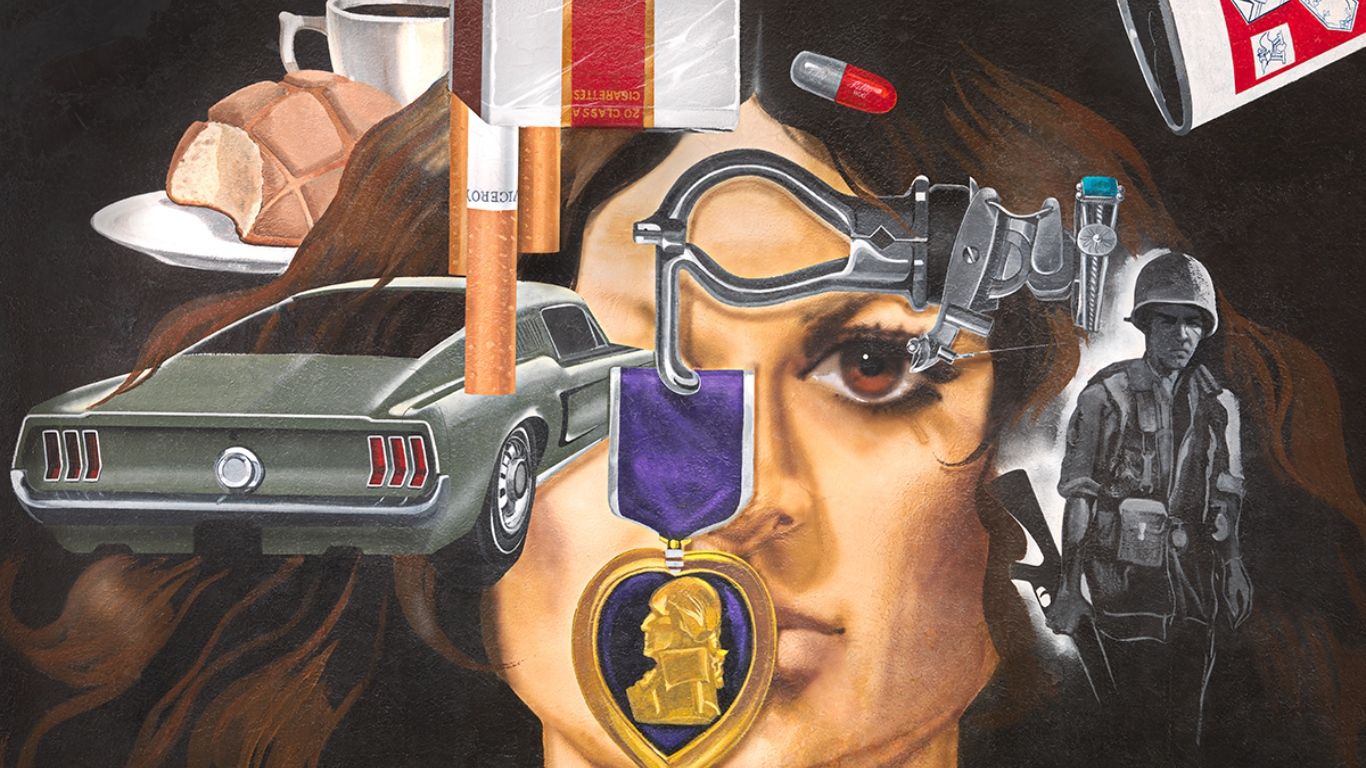

Investing In Anti-War Art: 5 Political Masterpieces That Can Become Valuable Assets

Art has long been one of humanity’s most powerful tools for protest, reflection, and change. Few themes carry as much weight—or as much timeless resonance—as anti war art. From Picasso’s towering Guernica to Banksy’s provocative modern street murals, artists have consistently used their platforms to condemn violence, spotlight injustice, and push for peace.

Beyond its obvious cultural importance, anti-war art also represents an increasingly sought-after segment of the fine art investment market.

Over the past two decades, artworks rooted in political commentary, especially anti-war statements, have seen average annual appreciation between 7% and 11%, depending on the artist, provenance, and visibility in major institutional exhibitions. This combination of moral relevance and financial resilience makes owning anti-war art uniquely compelling.

For collectors, family offices, and funds looking to balance cultural capital with long-term appreciation, these pieces offer a rare intersection of conscience and portfolio strategy.

Cabernet Sauvignon vs Chardonnay: Which Is Best For Investment? (2025)

When comparing Cabernet Sauvignon vs Chardonnay, the conversation goes far beyond taste preferences. These two iconic grape varieties not only dominate wine lists and cellar collections but also play a central role in the global fine wine investment market.

They offer different expressions, aging profiles, and financial trajectories—making the choice between them a strategic decision for serious collectors and investors.

Cabernet Sauvignon is often praised for its bold structure, firm tannins, and exceptional cellaring potential, especially in regions like Bordeaux, Napa Valley, and Coonawarra. In contrast, Chardonnay showcases elegance, texture, and stylistic diversity, with standout expressions coming from Burgundy, Sonoma Coast, and Yarra Valley.

Both varietals reflect their terroir deeply and have a proven record of delivering strong long-term returns when sourced from top producers.

Are A. Lange & Söhne Watches Good For Investment In 2025? (Best Models & ROI)

A. Lange & Söhne watches have positioned themselves as one of the most desirable non-Swiss investments in fine watchmaking. While brands like Rolex and Patek Philippe dominate headlines, collectors who prioritize low-volume craftsmanship and mechanical complexity are shifting attention toward Saxony, Germany—where A. Lange & Söhne produces fewer than 6,000 watches annually.

What separates A. Lange & Söhne from the rest is not just its finishing, but its scarcity and consistency in value preservation. References such as the Datograph Up/Down (Ref. 405.035) and the Lange 1 Moon Phase regularly outperform their retail price on the secondary market, while limited editions—like the 1815 “Homage to Walter Lange” in stainless steel—have broken auction records by multiples, reaching prices as high as $850,000.

Moreover, collectors are no longer buying these watches for the name alone—they are acquiring them for their in-house movements, hand-engraved balance cocks, three-quarter plates, and the reliability of a German production model that doesn’t flood the market.

The Best Renovations To Increase Your Property’s Value In 2025

When it comes to owning property, the right renovations can make a big difference—not just in how a home looks and feels, but in how much it’s worth when you decide to sell. Whether you’re a homeowner thinking ahead or an investor focused on profits, knowing which upgrades pay off is key.

Not all improvements add the same value. Some projects, like a smart kitchen update or an energy-efficient upgrade, almost always give you a strong return on investment (ROI). Others, like building a fancy wine cellar or putting in a backyard pool, might actually hurt your wallet when it’s time to sell. That’s why it pays to look at the numbers.

Recent studies show that some of the simplest renovations bring the biggest paybacks. For example, replacing an old garage door recovers about 93% of its cost at resale, making it one of the smartest moves you can make. On the flip side, an upscale bathroom overhaul might only get you back 50% to 60% of what you spent, depending on your market.

If you’re an investor, these details matter even more. Every dollar you spend needs to work hard—boosting the property’s value, attracting quality buyers or renters, and keeping your long-term profits strong.

How To Analyze A Company’s Earnings Report (2025 Guide)

For investors committed to sound decision-making, knowing how to analyze earnings reports is not optional—it’s essential. These quarterly filings are more than formal updates; they serve as the primary indicators of a company’s financial direction, risk exposure, and operational momentum.

In today’s volatile market environment, where stock price movements are often driven by sentiment rather than substance, earnings reports provide a structured way to cut through the noise.

Every quarter, Wall Street braces for what has become a predictable surge in volatility: earnings season. Institutional investors comb through these filings to recalibrate positions, hedge risk, or identify high-conviction opportunities.

At The Luxury Playbook, we don’t follow the market—we analyze it, decode it, and stay ahead of it.”